The Request for X (RFx) process has changed. Procurement leaders must apprehend that it is not a simple spreadsheet exercise that is solely focused on the lowest cost. Modern RFx is a sophisticated strategic tool, combining critical factors like risk mitigation, sustainability (ESG), and innovation into every supplier evaluation and selection.

The smart use of diverse supplier data is the essence of this transformation. We know this data expands your vendor list, but this is not the only outcome. It deepens procurement visibility, enriches competitive bidding, and directly supports strategic business outcomes.

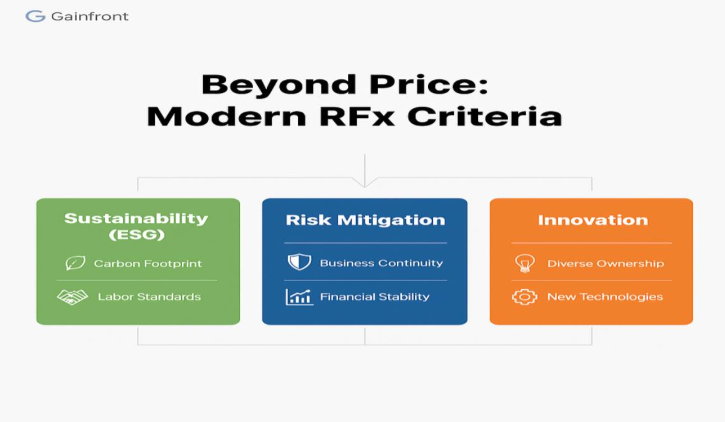

Expanding RFx Criteria: Risk, Sustainability, and Innovation

If your RFx documentation still only asks for price and delivery times, you are missing a massive opportunity.

Today’s best-in-class procurement teams commonly request detailed information on:

Environmental, Social, and Governance (ESG) Practices: What is the supplier’s carbon footprint? What are their labor standards?

Risk Mitigation Capabilities: Do they have robust business continuity plans? What is their financial stability rating?

Capacity for Innovation: Are they minority-owned, women-owned, or a small local business that might bring a disruptive technology or service?

Automating the Strategic Assessment

Evaluating suppliers on dimensions such as cost, risk, ESG, and innovation is necessary. However, this ushers in a huge amount of data. So, how do we manage this upsurge of data without bringing the sourcing process to a standstill?

The answer is utilizing technology to automate strategic assessment.

Vetting suppliers through manual spreadsheets should halt. The RFx process should be a data-driven engine that aligns sourcing decisions with risk management, sustainability goals, and innovation mandates. This change is backed by intelligent automation beginning with removing all manual obstacles.

The Shift from Spreadsheets to Strategic Filters — Powered by Gainfront

Often, this data influx impedes the manual sourcing process. Gainfront automates this elementary step with configurable pre-qualification workflows alongside AI-driven eligibility filters.

These filters reject suppliers who do not meet minimum requirements. These requirements are compliance orders, necessary financial margins, and important ESG criteria. Also, insurance coverage, cyber posture, or required certifications are certain other requirements.

By adding these filters into the RFx process, Gainfront removes time-consuming manual review cycles, so that procurement teams only engage with suppliers who meet pre-defined, non-negotiable standards. This reduces RFx cycle time so teams can work with competitive suppliers from the start.

Strategy Takes Center Stage with Gainfront’s Weighted Scoring Engine

After filtering out all unqualified suppliers, the focus shifts to strategic evaluation. Gainfront’s Weighted Scoring Engine operationalizes strategy over intuition.

Organizations use the platform to assign precise weights to every critical evaluation factor—not just cost, but also sustainability metrics, diversity status, financial strength, capacity, and delivery timelines.

The platform uses an objective and auditable scoring logic; it automatically evaluates supplier responses using a data-backed supplier selection process and clears subjective bias. Here is a shift in the fundamentals of procurement. The transactional “lowest price wins” approach evolves into a strategic, multi-dimensional evaluation.

The Power of Gainfront’s Diverse Supplier Data

Gainfront provides a genuine competitive advantage that is far beyond traditional compliance checks. This platform provides AI-enriched supplier profiles that have validated demographic database, socioeconomic classifications, and third-party diversity certifications (such as NMSDC, WBENC, SBA, ISO, etc.):

- Broader Supplier Pool: Gainfront pools in diverse, small, and local suppliers directly within the RFx process. This healthy competition reduces costs and gives access to innovative niche capabilities.

- Strategic & ESG Alignment: The RFx process accomplishes corporate ESG targets because of the qualification criteria.

- Bias Reduction & Better Market Intelligence: Gainfront proves potential sourcing gaps by continuously tracking diversity metrics at every RFx stage. These enriched supplier profiles show granular risk signals (financial, operational, ESG, cybersecurity) and innovation potential.

How AI-Powered Gainfront Elevates Every Decision in the Modern RFx

The goal of modern RFx is not to collect supplier data only. It expertly interprets, validates, and operationalizes that data according to business demands. This new capability is because now, Artificial Intelligence (AI) is the indispensable strategic partner for modern RFx.

As sourcing teams confront ever-increasing volumes of complex information, AI is fundamentally changing this dynamic.

Gainfront integrates EfficiencyAI™, an AI-driven engine purpose-built for supplier intelligence. This eliminates hurdles such informational noise, lack of data accuracy, and ultimately improves every sourcing decision.

AI-Powered Data Validation: Removing Manual Risk

When suppliers submit a complex mix of unstructured data: PDFs, certificates, annual reports, and free-text questionnaire responses, EfficiencyAI™ automatically extracts key data fields—be they financial metrics, diversity attributes, or specific ESG performance indicators. It cross-validates against internal rulesets or trusted external data sources removing manual burdens.

Beyond Automation: AI-Assisted Scoring & Recommendation Logic

Gainfront uses AI to analyze patterns across historical bids, past supplier performance, long-term risk scores, and complex compliance flags. It is a sophisticated analyst that autonomously indicates anomalies and finds suppliers that align with your highest strategic priorities.

AI-Driven Risk Intelligence: A Continuous Shield

EfficiencyAI™ continuously monitors enriched supplier data to discover early-warning risk signals in real-time throughout the RFx process:

- Sudden, material changes in financial health.

- Inconsistencies between claimed metrics and verified third-party certifications.

- ESG controversies or regulatory alerts in the news.

- Undisclosed cybersecurity vulnerabilities found in questionnaires.

Strategic Differentiators: AI for Diversity and ESG Insight Generation

Gainfront pairs diverse supplier data with the pattern-recognition capacity to detect Certification validity issues or expiration dates, gaps in diversity representation. This solution also determines which diverse supplier is likely to outperform current vendors based on past data. Moreover, it can easily detect inconsistencies in ESG scoring across different supplier responses

AI + Automation: Enhanced RFx

The traditional RFx process depends solely on manual effort and is prone to emotional judgment. On the contrary, the Gainfront RFx, depends on AI intelligence and automated workflows,. This combination creates a system that is remarkably faster and more Accurate; More Compliant and More Resilient.

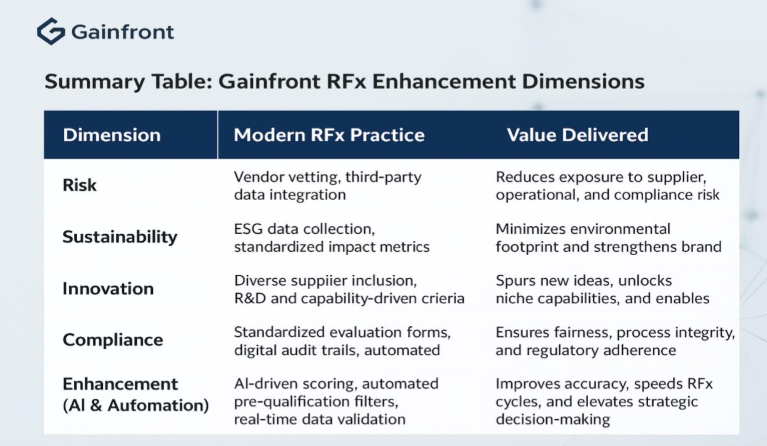

Summary Table: Gainfront RFx Enhancement Dimensions